Bank of america home equity line of credit calculator

What is a HELOC. There are no application fees no annual fees and no closing costs on lines of up to 1 million.

Bank Of America Mortgage Lender Review Nextadvisor With Time

A home equity line of credit and see what might make sense for you.

. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. Data provided by Icanbuy LLC. Combined with their long history and branches in 41 states this makes Wells Fargo one of the best places to go if you are interested in obtaining a home equity line of credit.

You have the option to choose a minimum monthly payment of 1 or 2 of your outstanding balance though some may qualify to make interest-only. Home equity loan and HELOC guide. Estimate your payment and rate.

The maximum APR that can apply is 18 or the maximum amount permitted by state law whichever is less. Home equity line of credit HELOC. A HELOC often has a lower interest rate than some other common types of loans and the interest may be tax deductible.

Home equity lender reviews. A home equity line of credit HELOC provides the flexibility to use your funds over time. Bank spread is the difference between the interest rate that a bank charges a borrower and the interest rate a bank pays a depositor.

For example home equity loan rates ranged from 51 percent to 589 percent in 2020 while HELOC rates. Home equity loan calculator. A home equity line of credit or HELOC is a type of home equity loan that works like a credit card.

All home equity calculators. Bank of Americas HELOC has a minimum credit line amount of 15000 in some locations but the minimum is generally 25000. You can borrow up to 70 of the value of your home.

The loan officers we worked with at Chase Bank were helpful and able to explain how each modification to their standard line of credit products would impact the structure of the product. No matter what large expenses you may face in the future a home equity line of credit from Bank of America could help you achieve your life priorities. The minimum credit line amount is 50000 or the minimum amount permitted by state law whichever is less.

HELOCs have a 10-year draw. Line of credit calculator. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin.

Also called the net interest spread the bank spread is a. A home equity loan or home equity line of credit HELOC allow you to borrow against your ownership stake in your home. What is a home equity loan.

You can use this calculator to get an idea of whether you can qualify for a home. A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans Footnote 1 such as credit cards. The APR on your home equity line of credit is variable based upon the Wall Street Journal Prime Rate plus a margin.

One of the nice things. Home equity loan calculator. Click here for more information on rates and product details.

The APR will vary with Prime Rate the index as published in the Wall Street Journal. For line amounts greater than 500000 maximum combined loan-to-value ratios are lower and certain restrictions apply. You authorize Bank of America to contact you at the telephone number or email provided here even if youve previously registered on a Do Not Call registry or requested that we not send you marketing information by.

Why Bank of America is the best home equity line of credit for low fees. Explore personal finance topics including credit cards investments identity. A home equity line of credit is the most flexible type of home financing available.

Established in 1971 and with a presence in 15 states Regions offers a full lineup of personal banking services including checking and savings accounts credit cards mortgages student. For Texas primary residences we will lend up to 80 of the total equity in your home and your line of credit amount cannot exceed 80 of the homes value. Youre given a line of credit thats available for a set time frame usually up to 10 years.

As with most home equity lines of credit Wells Fargo will charge interest during the draw period and you only have to pay on what you borrow. The maximum line amount is 1 million. How to borrow.

Home equity loan rates can vary depending on the lender and home equity product you choose. They do not offer home equity loans but their rates and fee structures on home equity lines of credit are some of the best in the industry. Payments do not include amounts for taxes and insurance premiums.

Third Federal Savings. Home equity line of credit HELOC calculator. During your 10-year draw period you can borrow as little or as much as you need up to your approved credit line.

Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit for an owner occupied residence with an 80 loan-to-value ratio for line amounts. USAA offers some of the best interest rates on home equity lines of credit available on the market. The interest rates are competitive with other types of loans and the terms.

Third Federal Savings. Bank of America Capital One Chase Citi and Discover. A home equity loan calculator is a good way to start exploring price options for tapping the equity in your home.

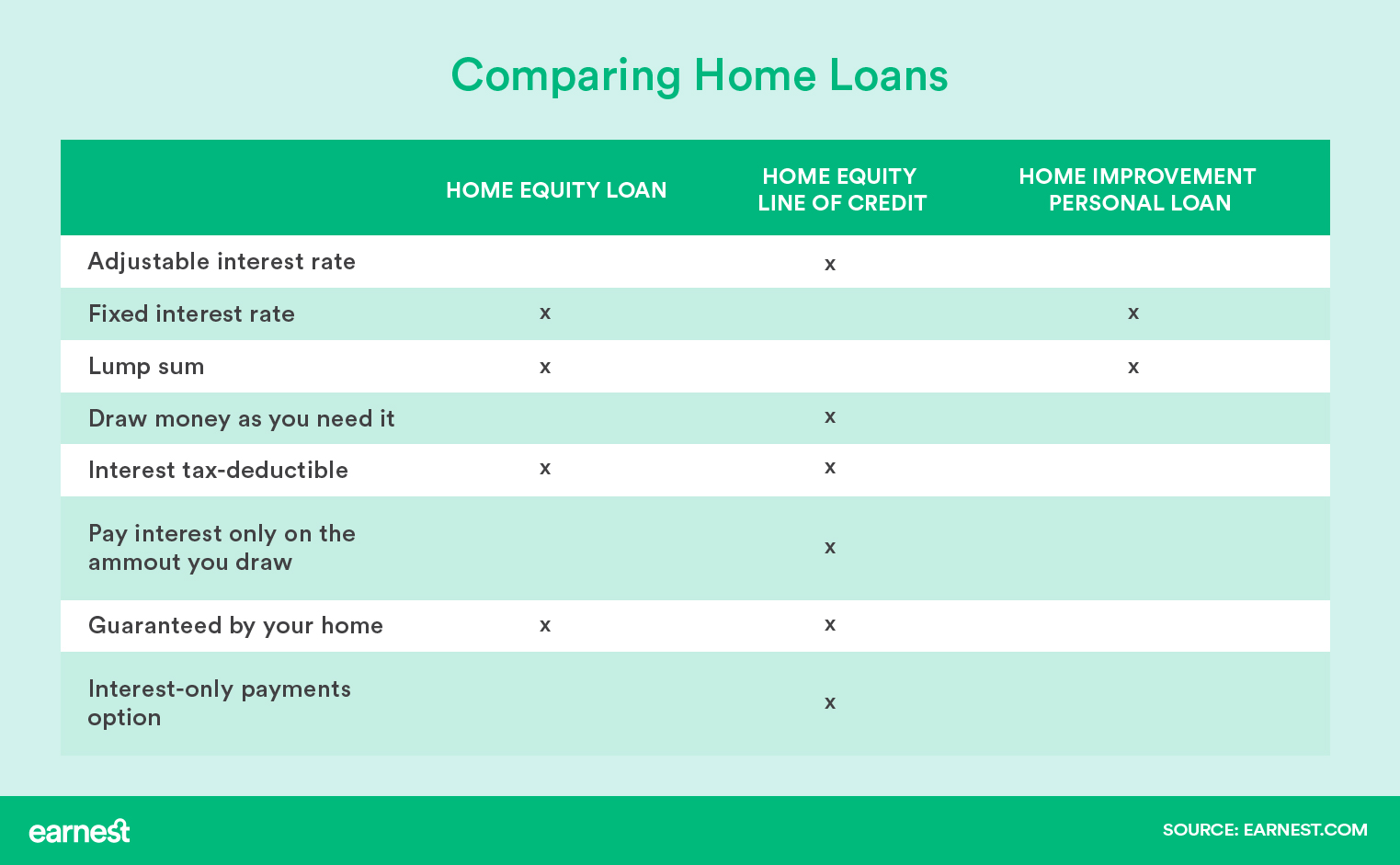

How to borrow. What is a HELOC. Compare the differences between a home equity loan vs.

Home equity line of credit HELOC. Home equity loan and HELOC guide. Line of credit calculator.

What is a home equity loan. Home equity lender reviews. This is impressive given how complicated these products can be and it shows why Chase is the largest home equity line of credit provider in the country.

All home equity calculators.

Home Equity Line Of Credit Heloc Rocket Mortgage

What Are The Advantages And Disadvantages Of Payday Loans For People With Bad Credit Payday Loans Bad Credit Payday

Real Estate Blog Home Selling Tips Home Buying Tips New Home Buyer

Mortgage Loan To Get Debt To Income Ratio Line Of Credit Home Equity

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest

Home Equity Line Of Credit Qualification Calculator

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Bank Of America Heloc Review September 2022 Is It A Good Idea Finder

Home Equity Loans Home Loans U S Bank

What Every Homeowner Needs To Know About Home Equity Home Equity Equity Money Management Advice

Pin On Naca Event Locations

How To Use Home Equity Line Of Credit U S Bank

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Bad Credit Mortgage Loans For Bad Credit No Credit Loans

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Home Loans U S Bank

Home Equity Line Of Credit Heloc Rocket Mortgage